Tax day: a time that strikes both fear and hope in the hearts of so many. Most people pray for a refund, but is that actually something you should want? While it can feel nice to get a big chunk of change in the mail, consistently getting a refund year after year can actually hurt your finances. Keep reading to find out why you don’t want a tax refund.

Think about it. This isn’t “free money,” it’s YOUR money! You loaned it to the U.S. government throughout the year, and it’s just now coming back to you. The government took out a loan from your paycheck, and come tax day, it gets to pay that back interest-free! You would never keep your money in a bank that offered 0% interest, right? And yet here you are.

According to the IRS, the average 2018 tax refund was $1,865, which works out to overpaying your taxes by about $155 per month. What could you do with that extra $155? Pay a little extra towards your debt? Invest? Avoid pulling from savings or using a credit card for unexpected expenses? Let’s be honest: many people use their tax refunds (and other large windfalls) as an excuse to buy things they don’t need. And even if you use MOST of it responsibly, you’re still losing out on some serious cash.

How much money are you losing, exactly? That depends on what you could have been using it for if you’d never given that loan to Uncle Sam.

Here are two examples of things you could do with that extra monthly cash that would save you in the long run.

Save on interest by paying down your credit card

Let’s say you owe $3,000 and you have a 15% APR. If you usually pay $100 per month, you will end up owing $3,784 (that’s 21% interest) and it will take you three years and two months to pay that debt. But, if you could increase your monthly payment with the $260 you’re currently paying in taxes, you’d only pay $3,188 (only 6% interest) and you would be able to pay off the card in nine months! Even if you used your return to pay off the credit card, you would still be overpaying interest to the tune of almost $600.

Start (or add to) a retirement account and reap the compound interest

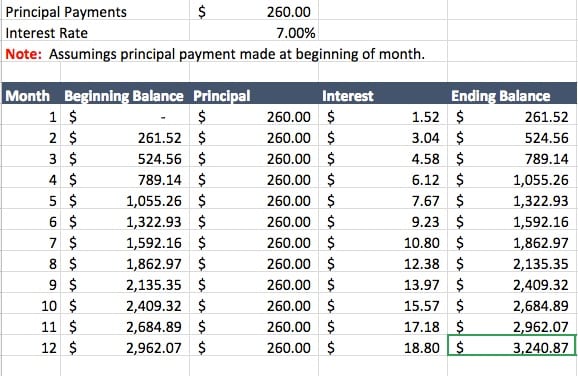

Some people put their return into a retirement account, but doing so can make you lose out on a year’s worth of interest. If you start a retirement fund with a 7% return and put in that $260 per month, at the end of the year you would have $3,240.87, a full $120 more than you’d get if you just put in your $3,120 in at once. And that is only year one! It will get compounded year after year:

So, how can I stop getting such a big refund?

In order to take advantage of these kinds of savings, you’ll need to fill out a new W-4. This is the form your employer uses to figure out how much tax to withhold from your paycheck. This includes your marital status, and any dependents you’re financially responsible for, and it gives employees the ability to add an additional amount they wish to withhold. Ask your employer for a new form and fill it out. You’ll need to figure out how much to withhold, so use this IRS Withholding Calculator to figure it out. You’ll need last year’s tax return and your last pay stub to start. This is also a good time to make sure you are filing correctly. Recently married? New Baby? Make sure your tax forms reflect your life changes. (Also: If you end up having to pay IN on tax day, be sure to check out our roundup of the best credit cards for taxes!)

To reiterate, this only works if you are going to use the money to save. If you aren’t going to use the money every month to invest in your future, take the lump sum in April. And it’s probably not worth the hassle if you are only getting a few hundred dollars back, but if you are expecting the average or more, this could help you build your financial future a little faster.

Would your rather get your tax refund month to month? Let us know in the comments!

The post Why You Don’t Actually Want a Tax Refund (Even if You Think You Do) appeared first on The Brad's Deals Blog.

No comments:

Post a Comment