If you’ve never had a credit card before, getting started with one can be pretty daunting for the beginner. Without any experience in the world of credit, how are you supposed to know where to start, or which card to apply for first?

We rounded up our favorite credit cards for beginners into an easy-to-read list, and broke down why each card deserves a spot in your wallet. For this list, we focused most on ease of use, good value of points, and annual fee as reasons a beginner should have this credit card.

The Best Starter Credit Cards of December 2020:

| Credit Card | Best For… | Main Benefit | |

|---|---|---|---|

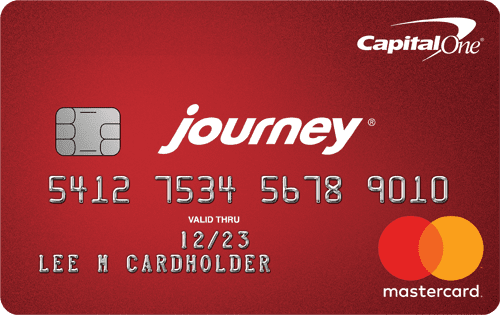

Journey® Student Rewards from Capital One® |

Students |

1.25% Cash Back |

|

Chase Freedom Unlimited |

Cash Back |

$200 Sign Up Bonus |

|

Chase Sapphire Preferred |

Travel Points |

60,000 Point Sign Up Bonus |

Journey Student Rewards® from Capital One® – Best for students

If you’re just starting to build your credit, there’s a good chance you’re a student. So long as you’re at least 18 years old, you can and should start building your credit by using a credit card responsibly – you’ll thank me in 10 years when you have a good amount of credit history to look back on. The Journey Student Rewards® from Capital One® card offers one percent cash back on all purchases, plus a 0.25 percent bonus when you pay your bill on time. We like this incentive, as it encourages good credit habits that a student can learn before moving on to more rewarding credit cards. There are also no annual or foreign transaction fees for this card, which makes it a great choice for students studying abroad. Check this card out.

Highlights from the Journey Student Rewards® from Capital One® Card

- One percent cash back on every purchase.

- 0.25 percent cash back bonus for paying your bill on time.

- No foreign transaction fees.

Chase Freedom Unlimited Card – Best for cash back

The Chase Freedom Unlimited Card offers 1.5 percent cash back on every purchase, and those purchases will be under a zero percent APR period for the first 15 months of card membership. There’s also a $200 sign up bonus when you spend $500 in three months, and no annual fee, which is why it made our list of Best Credit Cards with No Annual Fee as well! New to the card is the ability to earn 5% back on all travel purchased through Chase, 3% on dining at restaurants and drugstores, and 1.5% on all other purchases. In addition, earn 5% cash back on grocery store purchases (not including Target or Walmart purchases) on up to $12,000 spent in the first year. These cash back benefits are great, but you can increase your savings even more by securing an Ultimate Rewards credit card and transferring your cash back benefits at a one cent to one point ratio.

Highlights from the Chase Freedom Unlimited Card

- Pay no annual fee

- $200 sign up Bonus when you spend $500 in three months.

- 1.5 percent cash back on every purchase

Chase Sapphire Preferred Card – Best for travel points

We’ve made the case for the Chase Sapphire Preferred card in the past, but in case you missed it, the Chase Sapphire Preferred card has an annual fee of $95. Its points are easy to earn, with a 60,000 point sign up bonus for spending $4,000 in the first three months. Plus, you’ll earn double points for dining and travel spend, and one point for everything else. These points can be used in a lot of great ways, like how I used Ultimate Rewards points on my trip to the Maldives!

Highlights from the Chase Sapphire Preferred Card

- $95 annual fee

- 60,000 point sign up bonus when you spend $4,000 in three months.

- Double points on travel and dining spend

What was your first credit card? Let us know in the comments!

The post The Best Credit Cards for Beginners in December 2020 first appeared on The Brad's Deals Blog.

No comments:

Post a Comment